Trainings at ISPP, PFPP, and Open Takshashila | SEBI on insider trading | Bail crisis | TDSAT | CAAR | Capital controls | New videos | The TrustBridge Newsletter | Issue 20

Regulatory theory | OpenTakshashila course | SEBI on insider trading | Indian bail crisis | Data privacy matters at the TDSAT | Time for CAAR 2.0 | Questions that matter - three new episodes

This is TrustBridge’s monthly newsletter. TrustBridge seeks to improve India’s business environment by improving the rule of law. In this monthly newsletter, we bring you the work done by the TrustBridge Team in the public space and offer insights into future work.

Trainings Conducted

Natasha Aggarwal, Amrutha Desikan, Bhavin Patel, and Renuka Sane delivered a course on 'Regulation' as a part of the Indian School of Public Policy's postgraduate programme in Public Policy, Design and Management. Classes were conducted in the first three weeks of April 2025.

Upcoming Trainings

TrustBridge will deliver:

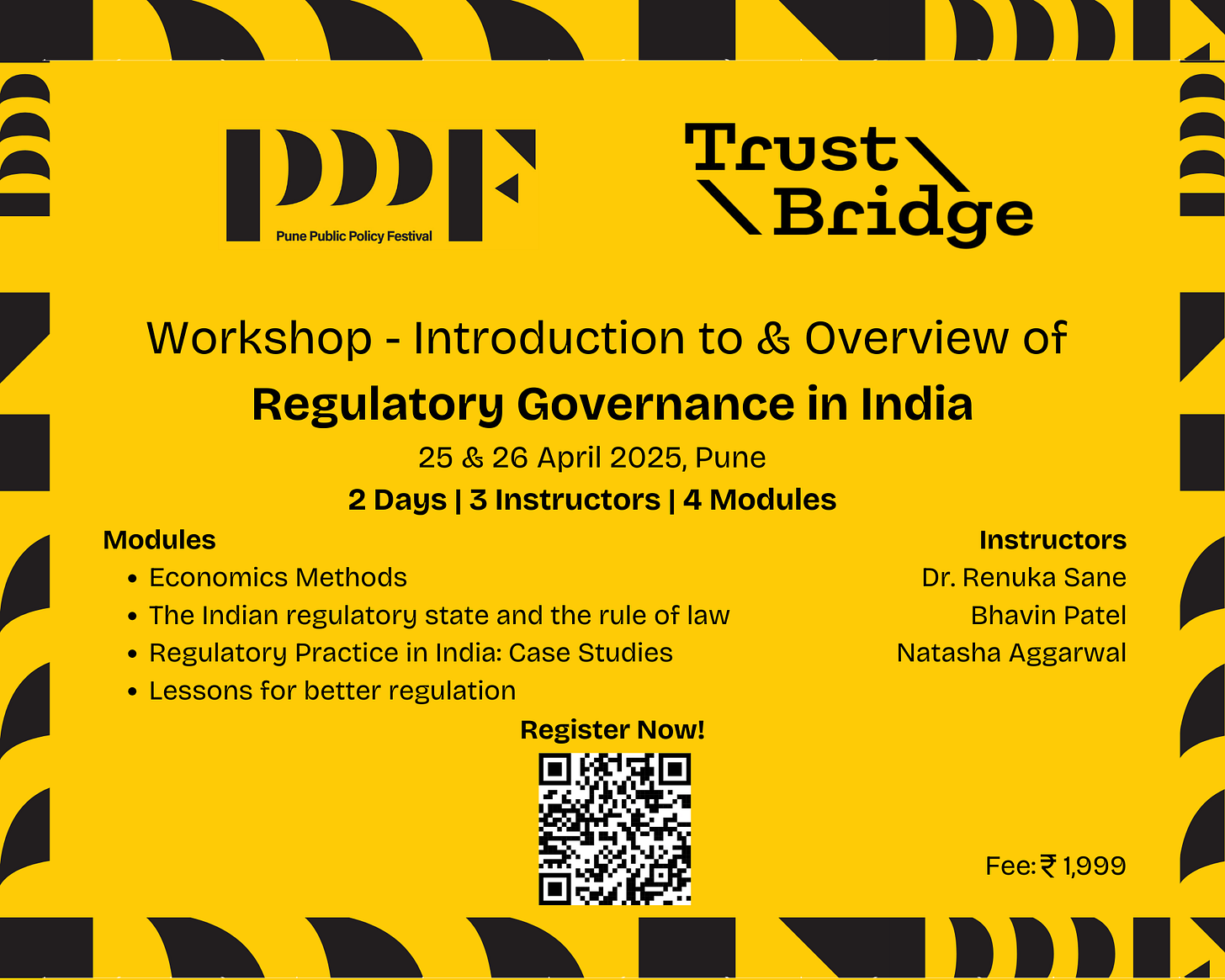

a workshop titled ‘Introduction to, and Overview of, Regulatory Governance in India at the Pune Public Policy Festival on April 25 - 26, 2025. Read more and register for the workshop here.

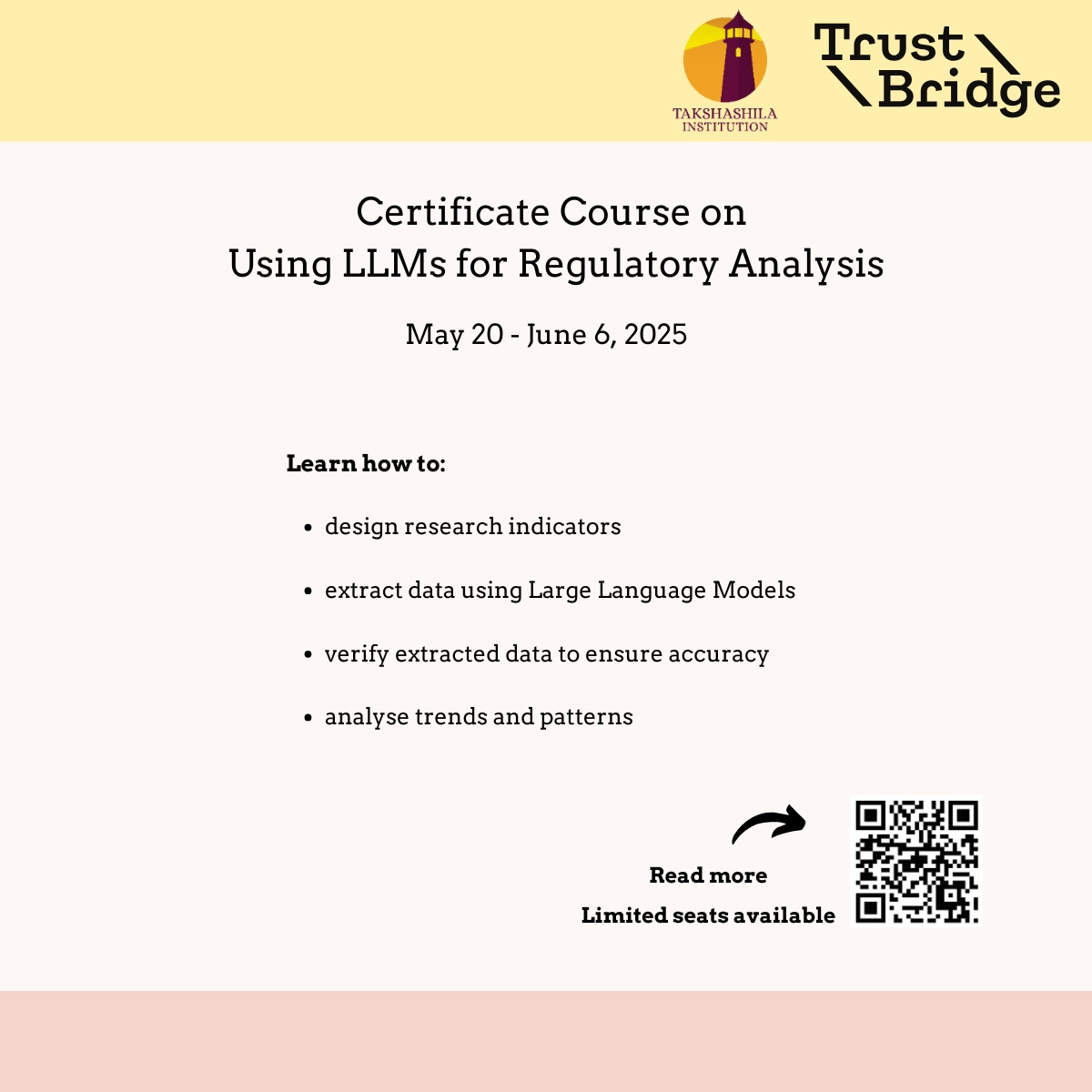

a three-week online course titled ‘Using LLMs for Regulatory Analysis’ on OpenTakshashila from May 20 - June 6, 2025. Read more and register for the course here.

Papers

Natasha Aggarwal, Amol Kulkarni, Bhavin Patel, Sonam Patel, and Renuka Sane published a paper titled "Balancing Power and Accountability: An Evaluation of SEBIs Adjudication of Insider Trading" on April 2, 2025.

The paper evaluates the Securities and Exchange Board of India’s (SEBI) orders on insider trading matters over a 15-year period and the performance of those orders in appeal before the Securities Appellate Tribunal (SAT). The paper develops an evaluation framework based on elements of the rule of law applicable to regulatory adjudication. It finds that SEBI orders often fall short of standards laid down in its own laws. The paper also evaluates how these orders have performed at the Securities Appellate Tribunal (SAT), and finds an overall appeal rate between 30-38%. This does not include more recent appeals that may not have been completed. Appeals are more likely when the monetary sanctions are higher than the minimum threshold of INR 10 lakh. Once appealed, almost 54% of the sanctions are modified. One way to improve on this performance would be through investments in capacity building in order writing.

A summary can be accessed here on the Leap Blog.

Op-eds

Renuka Sane wrote an article for The Print, ‘Tips to survive a market slump—stay invested, diversify portfolio, learn from World War I’ on March 19, 2025.

Predictions of impending doom may lead many of us to succumb to emotion and make reckless investment decisions. It is useful to remind ourselves that a reliable investment strategy is one that knows how to ride through the peaks and troughs of market cycles…

War and crises can wreak havoc in the short term. However, the economic cycle evolves, and markets eventually reflect the underlying productivity of the global economy. Short-term dislocations do not change the fact that innovation is a powerful driver of wealth creation. Continuing on the path of disciplined investing with a focus on long-term fundamentals is likely to emerge as the winning strategy in the long term.

Chitrakshi Jain co-authored an op-ed for Times of India with Prashant Reddy T., titled ‘Decoding the troubling pattern behind the great Indian bail crisis’, on March 18, 2025.

Our research suggests that many in the district judiciary are worried that granting bail would make them more susceptible to disciplinary enquiries. As per the Constitution, the high courts are responsible for administering the district judges, and this includes disciplinary powers over them. The trigger for such disciplinary action is often corruption charges but in many cases, the allegations are vaguely worded and based on hearsay accounts rather than eyewitness accounts.

Natasha Aggarwal published an op-ed titled ‘Telecom tribunal reforms to handle data protection pleas’ in The Hindu on March 20, 2025.

The increasingly important field of data protection poses a unique set of concerns and challenges, and matters relating to telecommunications are fundamentally distinct from matters concerning privacy and data protection. Such appeals may involve understanding and applying legal provisions on consent, access to personal data, and processing, storage, transfer and unauthorised use of personal data. These issues are substantially different from issues in the telecom sector, which underscores the need for specialised knowledge in data protection laws and privacy principles.

Renuka Sane and Bhargavi Zaveri Shah wrote an article for The Indian Express, ‘Let our money travel: RBI and government must allow retail investors to look beyond India’, on March 26, 2025.

As the depreciation pressure on the rupee mounts, the RBI and the government have been turning up the heat on money outflows from India. Increasing regulatory interventions with respect to capital controls and heightened scrutiny of outward remittances demonstrate the policymakers’ anxiety about currency depreciation. A clear adverse fallout of these interventions is the continued imposition of industry-wide limits on Indian mutual funds investing in foreign stocks. It is unclear whether this limit has had any impact on the value of the rupee. This limit has, however, restricted the ability of Indian investors to diversify their portfolios by taking on exposure to assets around the world. Buying when assets are cheap, as they are given the global turmoil, is a great strategy for wealth accumulation, and a well-diversified portfolio is key to a healthy household balance sheet. The RBI and the government must stop inhibiting Indian residents from exploring the diversification potential of their portfolio.

Chitrakshi Jain co-authored an op-ed for Scroll.in with Prashant Reddy T., titled ‘Why it is vital for Justice Varma to be given a fair hearing’, on March 30, 2025.

The Supreme Court has set a poor precedent for the future by sending a signal to the judges of the High Courts that any sundry allegation against them can be disclosed publicly before they have an opportunity to have the evidence forensically examined or an opportunity to cross-examine the persons making the allegations against them.

If judges staffing High Courts do not have confidence that the system will be fair to them when they face allegations they are going to think twice in the future while dealing with cases involving powerful litigants, be it governments or corporations. To that extent the probe against Justice Varma, is not just about him but the future of the decisional independence of all judges staffing the High Courts.

Prashant Narang wrote an article for Money Control titled ‘Time for CAAR 2.0: Revolutionising India’s customs rulings for global efficiency’, on April 7, 2025.

…while CAAR’s progress is commendable, there remains considerable scope for further refinement. According to a recent detailed study conducted at TrustBridge, analysing 414 CAAR rulings from January 2021 to August 2024, just 46.2% of rulings met the mandated 90-day timeline. This implies that more than half (53.8%) exceeded the statutory deadline, with delays ranging from a few weeks to over six months in some cases. Clearly, despite notable successes, CAAR still grapples with procedural bottlenecks that demand urgent attention.

Videos

We published three episodes of the series ‘Questions that matter’ on our YouTube channel:

Episode 1: Bypassing Expert Tribunals – Judicial Review in Electricity

Episode 2: The Arbitration Retreat: A short-sighted policy move?

Episode 3: SEBI’s Approach in Regulating Finfluencers